The Rabbit Ears of Unhappy US Taxpayers

I’ve lived in Italy for almost 2 years and still can’t speak Italian fluently.

My six-year-old son, Micah, speaks excellent Italian, and his friends’ parents, my peers, are more than happy to ignore me and talk with him.

It saves me a job.

But to improve, I started translating words and phrases I often use. It’s a common strategy to improve speaking ability.

A few Fridays ago, I stood in Piazza San Secondo with my Brazilian-Italian friend, Angelo, whose son plays with Micah. We speak terrible Italian to each other because he’s got to translate his Brazilian-Portuguese into Italian, and I’ve got to splutter through English in my head before any semblance of Italian comes out.

We both just bought houses and got onto the subject of finances. Shaking our heads, Angelo asked me how I was doing. I said, “Niente ma orecchie di coniglio.”

He looked at me quizzically, then his eyes widened, and then he burst out laughing.

Nothing but rabbit ears.

A man with rabbit ears.

Every married man knows exactly what this phrase means mere seconds after hearing it for the first time.

Usually, it’s with respect to a spendthrift wife, a recently made tuition payment, or a gigantic bar bill.

But now, married or not, male or female, we’re all up shit’s creek together.

While Paul Krugman can’t understand why people are so down on this allegedly thrilling economy, it’s easy to see why.

Everyone’s already broke.

A Few Facts First

A few days ago, Visual Capitalist published this excellent infographic on Global Wealth. I’m only showing the top ten. Click on the link to see the whole thing.

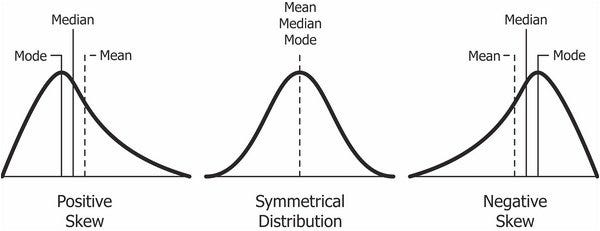

The two stats used are mean and median. Mean is a simple average. We take the total wealth and divide it by the total number of adults. However, averages are prone to big outliers. In this case, Warren and Charlie, Kim and Kylie, LeBron and Magic.

These billionaires pull up the average. That is, the number is positively skewed.

In the US’s case, the mean is much, much higher than the median partly because of the wealth inequality inherent in a capitalist economy and mostly because of the naked cronyism, enabled by an extravagant central bank and actioned by an irresponsible Congress, that passes for capitalism in America nowadays.

Right now, the average adult has about a $551,400 net worth. Not bad.

But the median US adult — the one in the middle of the pack – has only a $107,700 net worth.

From Visual Capitalist:

Many experts believe that median wealth provides the most accurate picture of wealth since it identifies the middle point of a dataset, with half of the data points above this number, and half falling below it. In this way, it is less impacted by extreme values and gives a good representation of the “middle of the pack.”

The number of US adults is 257 million, assuming Visual Capitalist used the 2020 census and counted over-18s as adults. If that’s the case, 128.5 million adults have less than $107,700. And most of that $107,700 will probably be home equity.

When you hear about “the hollowing out of the middle class,” this is precisely what people mean.

But that’s not all.

Let’s look at the big three economic numbers: GDP growth, inflation rate, and unemployment rate.

For this, we’ll enlist the help of John Williams of Shadow Government Statistics.

GDP Growth

My friend and colleague Doug Hill posted this on our editorial channel, and I just laughed. First, I had forgotten about John Williams. He’s a Reagan-era economist who was disgusted with how the USG fudged the numbers. Williams became very popular after the 2008 crash.

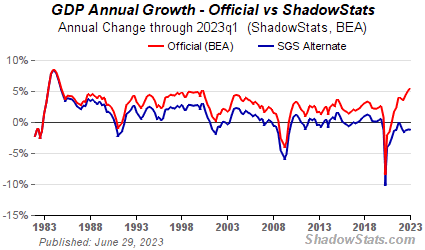

Here’s his estimate of GDP versus what the USG tells us:

The SGS-Alternate GDP reflects the inflation-adjusted, or real, year-to-year GDP change, adjusted for distortions in government inflation usage and methodological changes that have resulted in a built-in upside bias to official reporting.

Concisely, Williams’ estimate of US GDP growth hasn’t registered a positive number since before Covid.

So the whole “economy is growing” fairy tale turns out to be just that: a fairy tale.

Inflation Rate

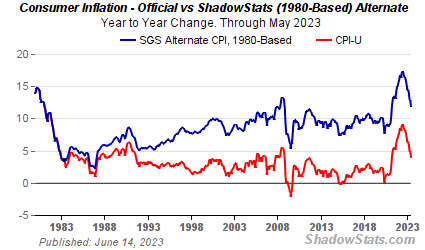

While we were panicking about a 9.2% inflation rate, Williams was decidedly more pessimistic:

The ShadowStats Alternative CPI-U measures are attempts at adjusting reported CPI-U inflation for the impact of methodological change of recent decades designed to move the concept of the CPI away from being a measure of the cost of living needed to maintain a constant standard of living.

At its peak, Williams had inflation closer to 17%. Right now, his work suggests that inflation is still in double digits. That’s a claim many would agree with.

Unemployment Rate

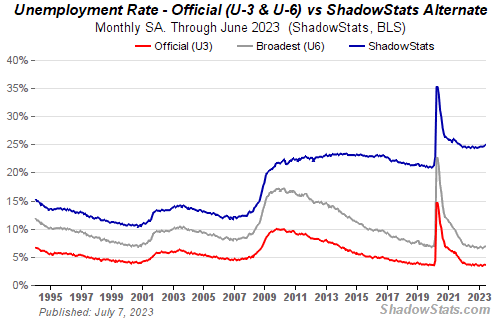

And unemployment isn’t nearly as rosy as Krugman thinks.

We’re still hovering around Depression-era numbers if you believe Williams. Many people do.

Williams explains (bolds mine):

The seasonally-adjusted SGS Alternate Unemployment Rate reflects current unemployment reporting methodology adjusted for SGS-estimated long-term discouraged workers, who were defined out of official existence in 1994. That estimate is added to the BLS estimate of U-6 unemployment, which includes short-term discouraged workers. The U-3 unemployment rate is the monthly headline number. The U-6 unemployment rate is the Bureau of Labor Statistics’ (BLS) broadest unemployment measure, including short-term discouraged and other marginally-attached workers as well as those forced to work part-time because they cannot find full-time employment.

But the USG’s efforts to fix the situation border on the farcical.

Rearranging the Deck Chairs on the Titanic

Before I get to the USG, let’s enjoy a bit of comedy. No, not from Paul Krugman. We’ve abused that privilege enough.

This comes from Greg Ip, former Fed watcher and now editor at The Wall Street Journal. In his Capital Account column, the sagacious Ip wrote this:

I suspect a lot of pessimism about the economy is “referred pain.” Just as part of your body can hurt because of injury to another, pessimism about the economy may reflect dissatisfaction with the country as a whole. Lately, there has been a lot to be dissatisfied about: intensifying political and cultural conflict and intolerance, the pandemic, the border, mass shootings, crime, war in Ukraine and now the war in the Middle East.

In other words, Americans are so worried about the wider world that they feel it in their wallets. Really?

In my experience, most Americans don’t give a rat’s ass about countries they can’t find on a map… But they are incredibly astute about how and when their government is picking their pockets.

And just when you thought you were getting relief that Congress has forgotten about Ukraine, along comes Israel.

Zero Hedge summarized it succinctly:

- The government will run out of money (again) in roughly two weeks, requiring Congress to act (again).

- According to Democrats and GOP Neocons such as Mitch McConnell and Lindsey Graham, America needs to send billions of taxpayer funds to both Israel and Ukraine, and won’t consider any legislation that doesn’t combine the two.

- House Republicans under newly minted Speaker Mike Johnson (R-LA), as well as a group of Senate Republicans, want Israel aid separated from Ukraine aid, while the Biden White House wants to jam a $105 billion foreign aid package ($14B to Israel, $60B to Ukraine) through Congress.

- The House’s plan (if they can even pass it) to separate Israel aid from Ukraine aid is DOA in the Senate, while both the Senate’s combined package and the Biden admin’s package is DOA in the House.

- The House and the Senate also need to pass 12 appropriations measures for 2024, or face a 1% across-the-board cut on defense and nondefense spending, per the debt ceiling bill passed earlier this year.

In an update, Biden already vetoed the House bill that would have (GASP!) separated Israel from Ukraine.

But the real reason Biden was pissed off was that the GOP planned to offset $14.3 billion in aid to Israel by reducing the IRS’s roughly $60 billion boost from the Inflation Reduction Act ($80 billion less negotiated cuts).

I have to say, “Nice try, Mr. Speaker. Well played.”

But what I don’t see is any help for everyday Americans. Where’s a middle-class tax cut? Where’s relief for Maui or East Palestine? And where the hell is increased funding for the border?

All these taxpayer dollars are going out of the country, and none is going for inward investment.

Wrap Up

Unless and until the citizenry wakes up, this will continue.

If I were Joke Biden, I’d take advantage until I came out of the Oval Office feet first.

As for the Congressional gerontocracy, they’ll keep going until they get Feinsteined.

Comments: