Adding to this problem is that the generations following the baby boomer generation are even worse off and America's economic picture is less than rosy. It does not help that Americans have been encouraged over the years to spend and incur debt rather than save. This encouragement comes from politicians hooked on the idea consumer spending creates a strong economy.

This results in many people retiring with little savings and dependent on a government already deep in debt to care for them in their older years. Those of us that have studied the numbers come to shaking our heads in horror, simply put, something has to give and most likely promises will be broken, When words like unsustainable and insolvent have been muttered they simply get brushed aside by daily life.

For years those in power have hidden and sheltered Americans from the harsh truth that the numbers simply do not work but history shows politicians would rather kick the can down the road than deal with reality. To the many people that have been looking forward to a comfortable and leisurely life in their older years. The fact that things could be worse is not something that will cause most retirees to leap with joy.

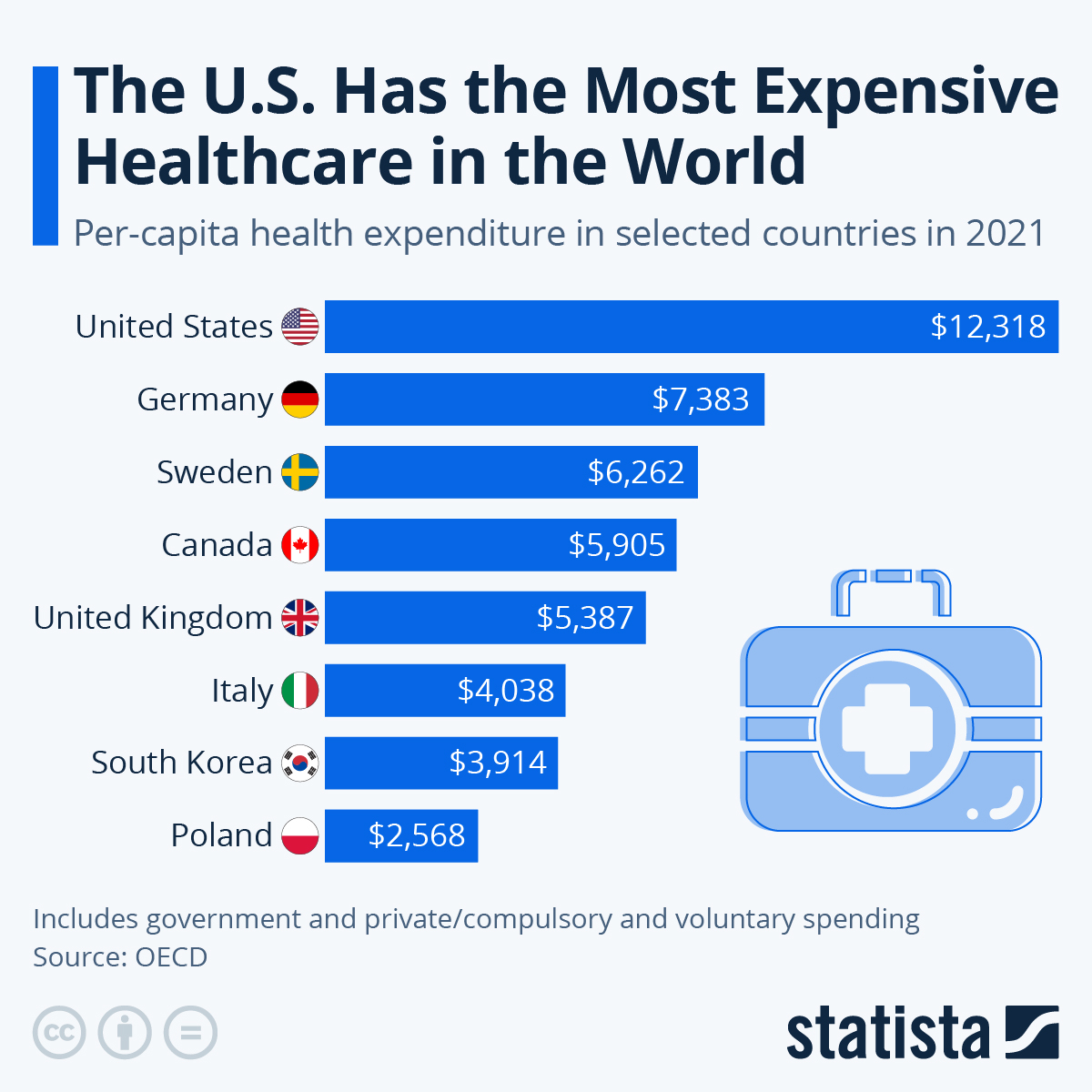

An example of what we face is evident in healthcare. this is a sector of the economy that Washington has pledged to fix and even claimed it has. The chart put out by Statista shows the U.S. has the most expensive healthcare system in the world. This matters if you consider it as a tax on the American people and realize that healthcare is a major expense for people as they age. This hits medicare directly in the heart meaning as cost soar for the program something will have to be done. That something generally comes in the form of cutting benefits and charging recipients more.

An example of what we face is evident in healthcare. this is a sector of the economy that Washington has pledged to fix and even claimed it has. The chart put out by Statista shows the U.S. has the most expensive healthcare system in the world. This matters if you consider it as a tax on the American people and realize that healthcare is a major expense for people as they age. This hits medicare directly in the heart meaning as cost soar for the program something will have to be done. That something generally comes in the form of cutting benefits and charging recipients more.

While there is more to life than money, few people choose to live in poverty. Unfortunately, even most Americans that have saved over their lifetime and done the right thing are in peril.

Over the years, the Fed has inflated the money supply and in doing so it also inflated asset prices, including stocks, bonds, and real estate. Much of this is the result of ballooning debt. Make no mistake about it, the government has fed at the debt trough and it has made our future less promising. Yes, we are roughly 33 trillion in debt, not counting the unfunded liabilities of social security, medicare, and Medicaid.

|

| While This Is An older Chart, Little Has Changed. Reality Is Not Pretty |

With the current trajectory of economic policies and inflation running above the return savers can earn from safe investments things will only get worse for retirees and those close to retirement age. Considering the amount of debt already amassed, the government is going to have a difficult time putting together generous new aid packages to come to the aid of those dependent upon its programs. This will result in conflict as both the young and the old are forced to fight over the few scraps it can provide.

All this has created a situation where if the money supply now contracts a huge number of defaults will occur and both businesses and investors will incur big losses. This threat to 401Ks and pension plans is real and would make many boomers collateral damage in any effort they make to correct the mess they have created. Those in or nearing retirement should make an extra effort to reduce risk and keep their savings safe.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Excellent article, Bruce-and true-I am 70 and still working full time.

ReplyDeleteMore stories of retirement promises broken in the video below. I just saw this and thought I would pass it on. https://www.youtube.com/watch?v=dKlSOi5f6tQ

ReplyDeleteThank you, Bruce

Delete